How Much Gold Can You Buy Without Reporting in Australia?

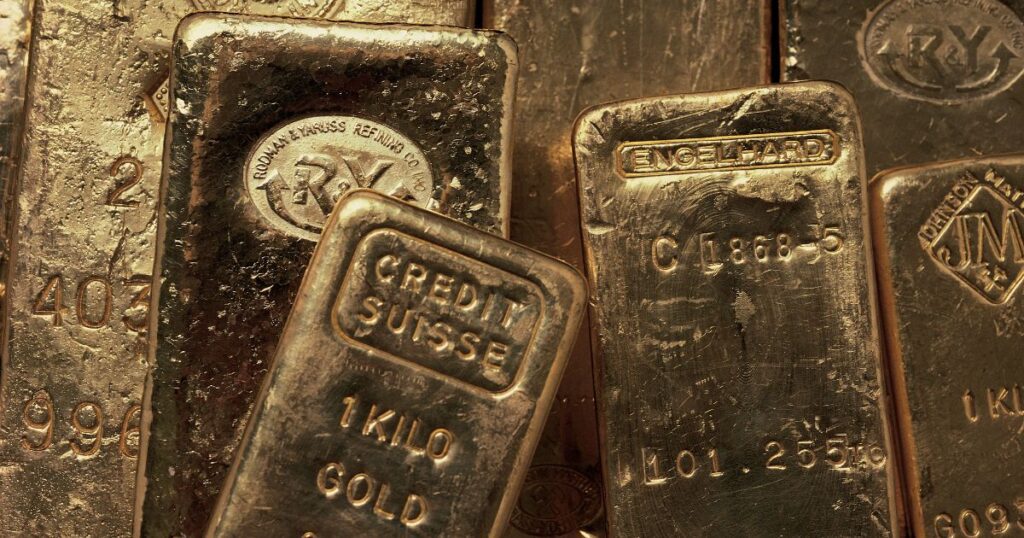

Gold has long been considered a stable investment and a worthwhile store of value. However, many individuals need clarification on the reporting requirements for purchasing and transporting gold within Australia. This is an understandable confusion, as tax laws and monetary value thresholds can change over time.

In this post, we will explore how much physical gold you are legally allowed to purchase or transport without requiring an official declaration from the Australian Taxation Office (ATO). By understanding these guidelines, buyers and sellers can engage in safe gold transactions aboveboard. Repeating our primary keyword, let's start by addressing the question - how much gold can you buy without reporting in Australia?

When considering purchasing or transporting gold within Australia, it's important to understand the reporting thresholds set by the ATO. These guidelines aim to regulate large transactions involving precious metals and monitor cash flows over a certain value.

By complying with the reporting limits, buyers and sellers demonstrate transparency while enjoying the freedom to trade within the law. Specifically, the reporting threshold for physical gold refers to the maximum amount an individual can acquire before identification and paperwork are required.

How Much Gold can I carry To Australia?

When transporting gold, whether purchased abroad or domestically, travellers need only declare quantities exceeding certain limits. For gold jewellery, the reporting threshold is an estimated value of over $10,000. This allows international visitors to freely bring rings, chains and other precious accessories without extra scrutiny.

Visitors might wonder - how much gold jewellery can I carry to Australia? The answer is jewellery with a total gold content valued under $10,000 remains exempt from formal taxation paperwork.

Gold Secure is Your Reputable Gold Dealer

For over 30 years, Gold Secure has been the most trusted name in gold and silver bullion in Brisbane, catering to buyers and sellers alike. As a long-established business with an impeccable reputation for fair pricing and reliable service, Gold Secure can provide buyers assurance and convenience when acquiring gold.

Repeat customers as well as new clients benefit from the industry expertise and wide selection of internationally recognized brands always in stock. Whether you have a small portfolio or are making larger investments, Gold Secure ensures your gold transaction is handled professionally and securely every time.

Conclusion

In summary, Australians have relative freedom to purchase, transport and trade gold within legal reporting limits. By understanding these guidelines, individuals can buy or sell with full transparency and peace of mind. For over 30 years, Gold Secure has helped countless clients securely buy and sell gold aboveboard in Brisbane.

Their expertise ensures the best prices, products and services. Whether starting or growing your portfolio, consider Gold Secure for a reputable gold transaction that adheres to local laws and benefits from a trusted dealer's experience and protection. In conclusion, now you know - how much gold can you buy without reporting in Australia.

Categories

Latest Posts

-

Digital Gold vs. Physical Gold: A Comprehensive Guide

March 1, 2024 -

How is Gold Mined in Australia: A Deep Dive into the Extraction Process

February 21, 2024 -

How To Get The Most Money For Your Gold Jewellery

February 15, 2024 -

Beginner’s Guide on How To Sell Silver in Australia

February 7, 2024 -

How To Invest in Silver in Australia For 2024?

January 31, 2024 -

How Gold is Tested? All You Need To Know

January 25, 2024 -

Gold Bullion and SMSF – All You Need To Know

January 19, 2024 -

Cast Bars vs Minted Bars – Clear Comparison

January 10, 2024 -

What is Platinum?

January 2, 2024 -

How To Invest in Gold ETF

December 21, 2023 -

The Largest Gold Nuggets Ever Found

December 18, 2023 -

What is Digital Gold and How Does it Work?

December 13, 2023 -

Best Ways To Invest in Gold in Australia

December 7, 2023 -

How Much Gold is There in the World?

November 29, 2023 -

Where and How To Store Gold and Silver?

November 23, 2023 -

The Relationship Between Gold and Inflation Over the Australian History

November 16, 2023 -

How Does Gold Refining Work?

November 9, 2023 -

Gold Bars vs Gold Coins: What Should You Buy?

November 1, 2023 -

Know The Cheapest Way To Buy Gold

October 25, 2023 -

Why Invest in Gold? Top Reasons to Consider

October 18, 2023 -

How Much Gold Can You Buy Without Reporting in Australia?

October 15, 2023 -

The Best ASX Gold Stocks in Australia For 2023

October 9, 2023 -

Top 10 Australian Gold Mining Companies in 2023

October 5, 2023 -

How to Sell Jewellery in Australia?

October 4, 2023

07 4939 0239

07 4939 0239